Brand and Product Positioning For Kindful

During both my experiences at Kindful, I conducted brand and product positioning exercises. In the first instance, we simply didn’t have a defined focus that would allow us to move quickly and with confidence. The second time around, the company knew a lot more about its audience and customers, which revealed that the earlier positioning needed redefining and more thought, especially as the marketplace was getting more crowded with competitors.

I’ll outline both processes below. The first process followed the Storybrand framework, while the second followed a framework I developed myself.

Round 1: Brand positioning using the Storybrand framework

A few months after I joined Kindful, we decided we were in need of clarified brand positioning. There were several factors that went into this.

Challenge

We weren’t moving fast, stuck in cycles of indecision, and it seemed like everything we produced ended up being remade or redirected after a couple weeks. Our team was floundering, without a North Star to aim toward.

Our team was also learning more about our audience, which opened up more questions, then rolling into the cycle of indecision. And, having done this process now for multiple brands, I know that it doesn’t matter what the brand playbook is as much as it does to just have a shared understanding and focus.

The other challenge was our lack of budget. Kindful was still in its infancy, and we didn’t have 50, 100, 200 grand to pay an agency for a brand audit and positioning study, so we had to do it all internally. This is why we decided to go the Storybrand route—it was a framework we could all follow and get on board with.

Process

As a team, we read through Donald Miller’s Building a StoryBrand and followed the steps he outlines in the book. There are several elements that we filled out together:

Character: who our target customer is.

Problem: the core challenge or problem our target customer faces.

Guide: how our brand demonstrates authority and empathy as a guide.

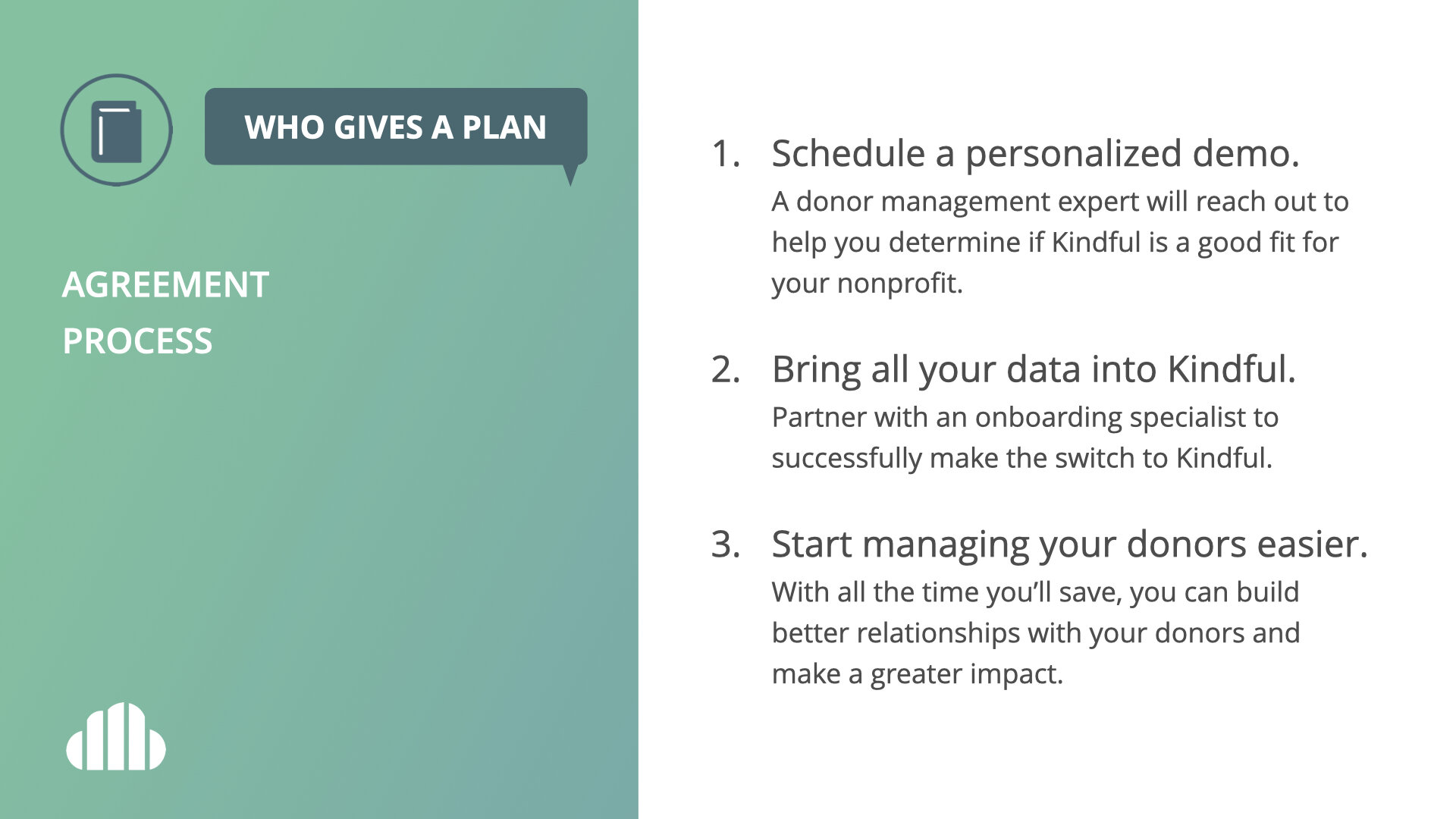

Plan: the steps to take to solve the problem.

Call to action: impetus for adopting the plan.

Result: what success and/or failure looks like for the customer.

Aspirational Identity/Transformation: ways the customer transforms through the process.

Each day we worked through a couple of these items to fill out the framework. There was a lot of back and forth discussion, outlining what we thought would resonate based on what we knew of our audience and the anecdotal feedback and data we had available to us.

Product

At the end of the process, I presented the new brand script to the company. We had some practical copy and one liners that everyone could adopt, pulling the entire company culture in the same direction for the first time.

1. Kindful Branding Workshop to present the StoryBrand framework

This is a recording of the brand workshop I presented at the end of the branding process.

2. Kindful StoryBrand Presentation

Below you can find slides from the branding workshop presentation.

3. Kindful Brand Guidelines

This PDF was a made as a quick reference for all employees. It covered the brand script, messaging references, and palette and logo use. I designed the layout in Apple Pages.

Results

Unfortunately, I didn’t stick around long enough to see the results. We implemented the new branding about two months before I got a job elsewhere. But the initial homepage test was a success, proving that simplified messaging and consistent positioning was stronger than the piecemeal approach we previously employed.

Round 2: Brand and Product Positioning, self-defined process

I was re-hired at Kindful as the senior manager of brand strategy, because the product was in need of some swift repositioning.

Challenge

By the time I returned to Kindful, the company had returned back to an ill-defined state of positioning and direction. The StoryBrand had worked okay, but was not fully adopted over time, and the approach and focus was watered down as a result.

Personally, I had also discovered that it was somewhat limiting in scope. The StoryBrand framework didn’t take into account competition, the larger market trends, what any feedback from customers or prospects. It assumed that you knew a lot of the information, and didn’t suggest avenues for acquiring any of that detail, or conducting any research.

I also had experience with archetypal branding at this point, and wasn’t convinced that was the right framework either (it, again, assumes you know a lot about your audience, and leans too heavily on voice/palette and competition, as opposed to a wholistic positioning strategy).

The other challenge I faced was the lack of roadmap and forecasting. Kindful’s mission was to provide nonprofits with fundraising tools, flexible API and integrations, and ownership and authority over their data. And while this could be a fairly robust position to grab hold of, there was not a lot of shared meaning around these goals, and there was not any strong focus on who in the market this serves, or where this would take us five years down the road.

I thought the mission was short sighted, so I needed to provide positioning recommendations that would put us in a good place to outpace our competitors in five years.

Process

To be as thorough as possible in my information gathering, I did a comprehensive dive into very aspect of the business. Here are some of the areas I researched:

Current branding and positioning

Competitive landscape

Customer analysis

Market analysis

I’ll break down each section to look at the info I gathered and how I conducted my research.

Kindful's current branding and positioning

To know where we should be headed, I needed to understand where we were at that moment. I scrubbed the site for any changes in palette and specific use of imagery. I also started on the website to understand positioning and how we were presenting to our market.

Then I looked at Kindful’s reviews in G2 to see how others perceived the product. This would later inform comparisons and provide insight into new positioning.

Competitive landscape

The nonprofit CRM space is not as crowded as, say, the email marketing space, but there is a decent amount of competition—especially since most nonprofits don’t have sophisticated programs, which means they’re drawn to less sophisticated tools, caring more about the process of fundraising than understanding and managing their donor contacts.

I created the list of competitors from internal stakeholders as well as G2 and my own experience. Then I pulled branding and positioning themes from their sites, while browsing through G2 for review themes from their customers.

Customer analysis

There were a few inputs that I used to evaluate who our product was good for and what those people thought about Kindful.

But first, why I think this is important for branding: Branding voice, tone, archetype, colors, etc., are all well and good, but the more you know what resonates with your target customer, the likelier you are to create a brand that resonates.

Taking that further, a brand and product position must be connected. I’ve seen brand-led SaaS businesses deliver incredible marketing experiences, and then the product is trash. Likewise, I’ve seen product-led organizations that are dependent on really mature and defined product strategies. But, in the absence of such maturity, sometimes a marketer thinks their only choice is to inflate the brand experience. My approach is to find the best of both worlds. I am also confident that these two factors are intertwined, since statements about the product must be informed by the brand.

Okay, back to customer research.

Customers who love us: My first look was at customers that love us, meaning those that gave Kindful an NPS rating of eight or above. I profiled these organizations to see what their comments were, what their organizations looked like, and how they used Kindful.

General customer sentiment: Taking Kindful’s core features, I searched within our NPS tool to see what customers had to say about these features and services, painting a picture of customer perspective.

Customer and prospect interviews: I conducted several interviews with both power users and average users to get verbatim perspective on how Kindful works and what it’s best for. I also did ride-alongs with sales members to hear how prospects viewed Kindful’s offer.

I synthesized all of these detail into overall themes and trends.

Market analysis

The final area of research was in the market. I approached several factors to get a well-rounded perspective.

1. Consumer trends: Looking at major movements in consumer trends, I drew a line to see how these could impact our target market down the road.

2. Market trends: For this piece, I dove into total addressable market data, as well as where other offers in the space sit and how our target audience might consider the landscape.

3. Site prospect data: Pulling data using Google Analytics, I started to draw conclusions about how the market viewed Kindful, what they wanted to know more about, and the problems Kindful would solve for those that knew about us.

Product

I presented my findings to the COO and CEO, demonstrating where there’s opportunity, and outlining different paths we could take based on the strategy we wanted to adopt.

PRESENTATION

Research, Findings, and Recommendations

Here’s all the research compiled into one deck, with my recommendations and implementation strategy at the end.

WEBSITE

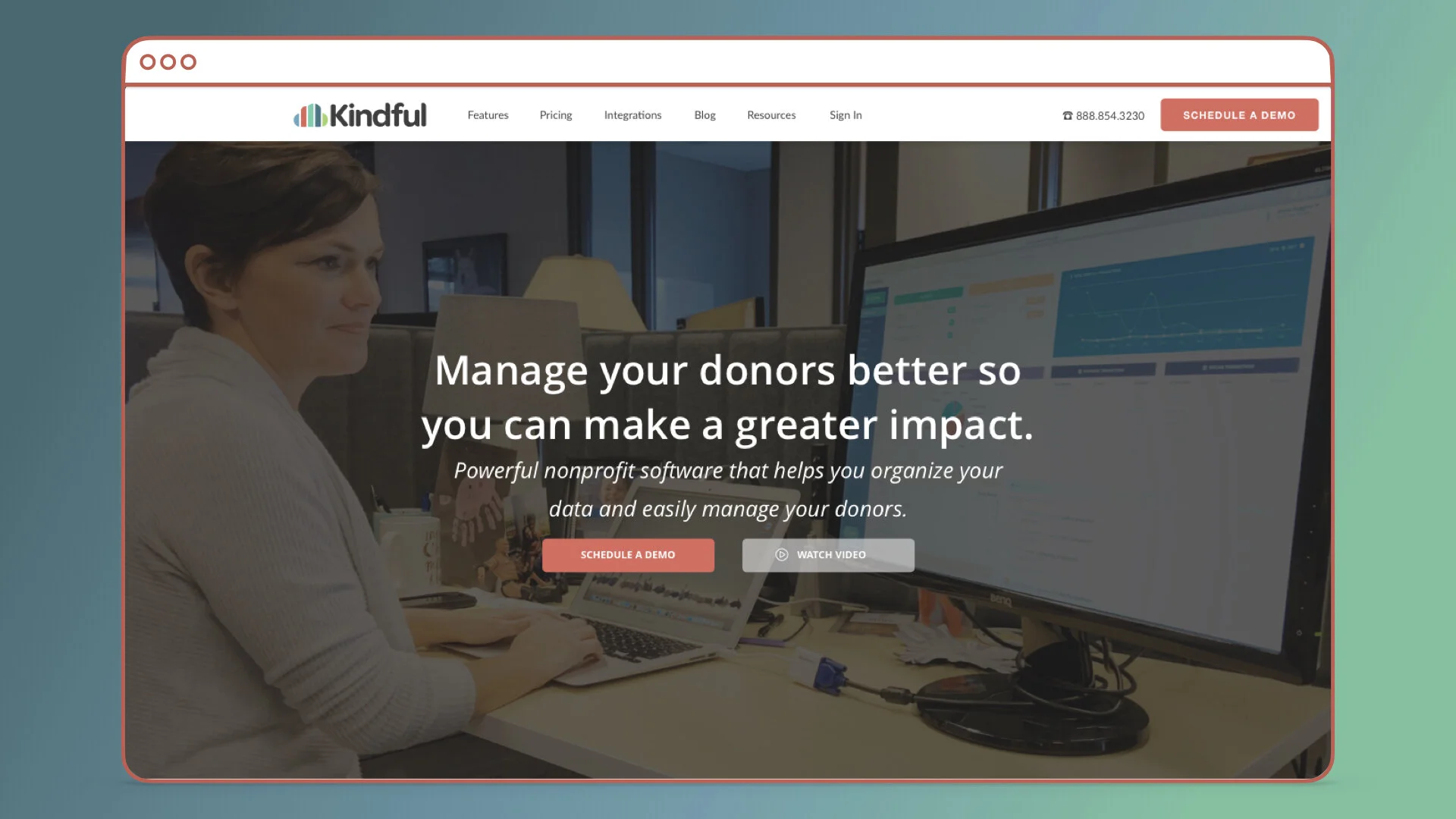

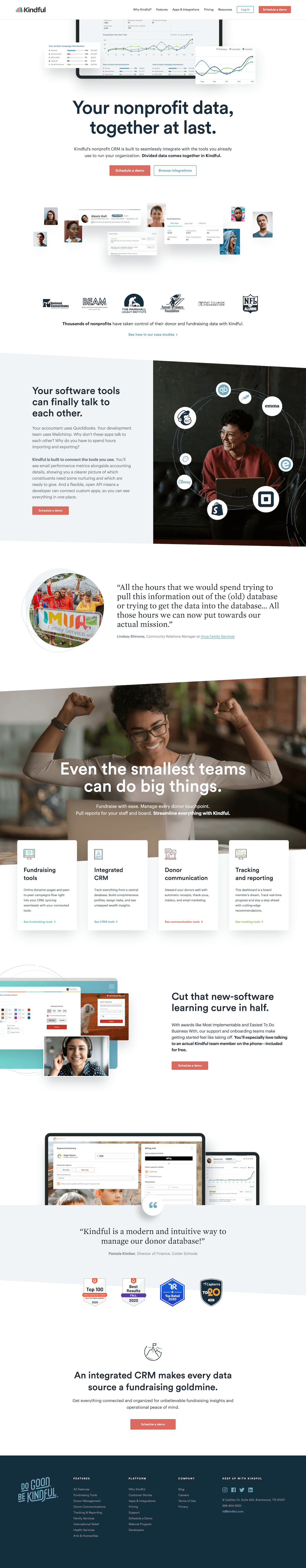

Positioning test on homepage

The most immediate outcome of the project was a new homepage test, on which I would leverage the hypothesis derived from my research. I got Google Optimize implemented on the site, and worked with our web agency to create a new homepage design.

My responsibilities:

Strategy for positioning and messaging, content structure, and user flow for the new homepage.

Managed agency’s design recommendations and honed created.

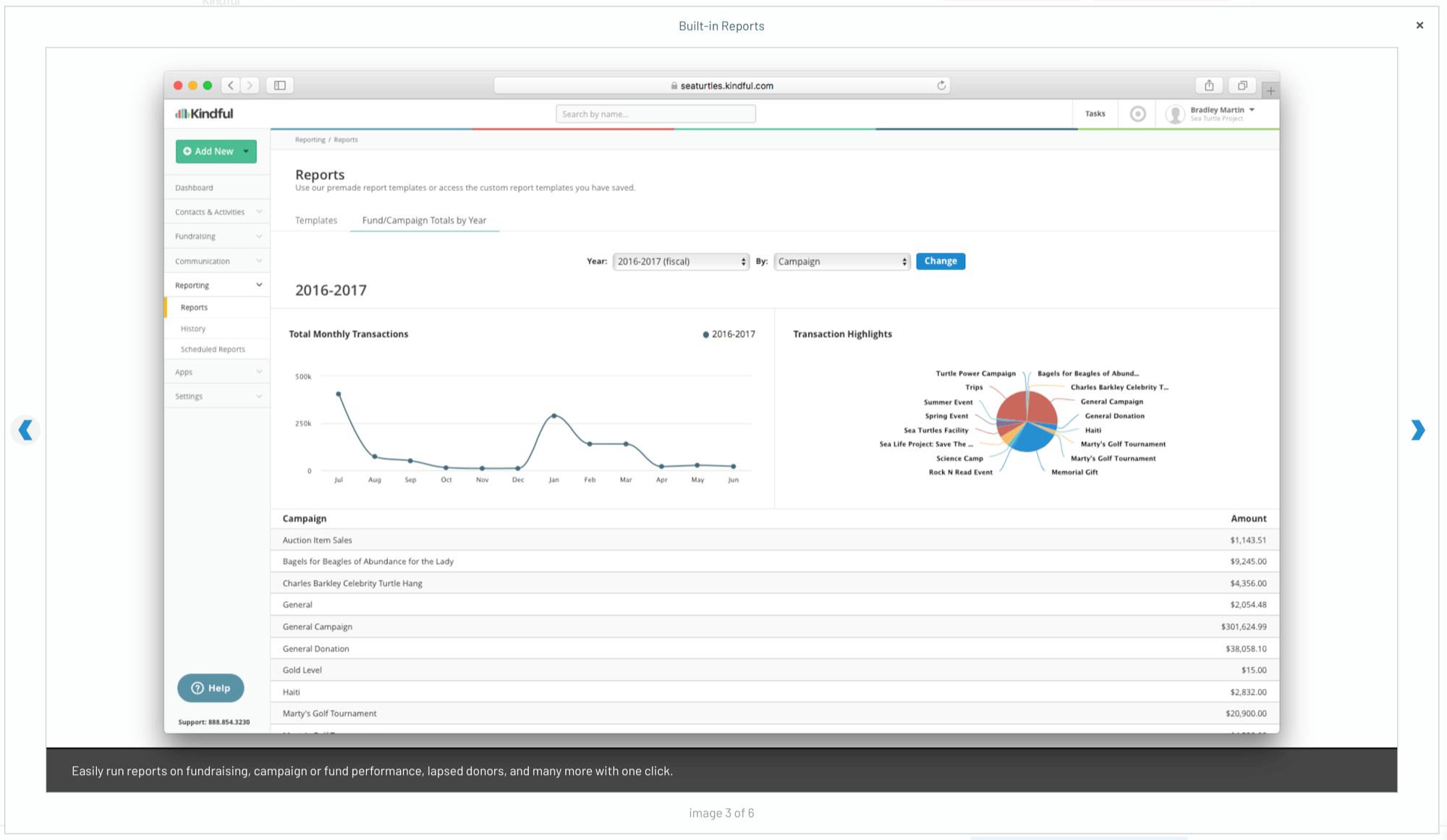

Created product image mockups and galleries.

Supplied image recommendations.

REFERRAL CHANNEL

G2 listing updates

Our listing was in need of some love. I reviewed and updated all the images for a more lead-enticing listing.

My responsibilities:

Implement new strategy into feature copy.

Write copy for listing images.

Design listing images.

Results

The homepage test ended up testing similarly in demo requests, time on page, and bounces. But the test ad a 20% increase in sales velocity, and produced 15% higher pipeline revenue than the original. This was enough to validate my hypothesis, showing that it communicated the value of the platform almost immediately when compared against the control.